Oh, how we wish there was a simple answer to this question… Car tax rates in Ireland vary depending on whether we’re talking about purchase tax, or the motor tax that you must pay every year to use your car on the road.

Purchase taxes

Let’s start with purchase taxes, and we mean plural because there are two — VRT and VAT. VAT is self-explanatory, and is simply paid as the same 23 per cent Value Added Tax as charged on anything that you buy which qualifies for that tax.

VRT is a little more complex. Vehicle Registration Tax is essentially a hold-over from before Ireland was a member of the European Union. Prior to EU membership, Ireland charged withering import duties on the purchase of new cars, unless those cars were actually made in Ireland. Hence why so many major car makers — including Ford, Fiat, Toyota, Renault, Volkswagen, and even Mercedes — had major manufacturing operations in Ireland up until the mid-1980s. Those factories were essentially making kits of parts sent to Ireland from other factories (or CKD, as it was called — Completely Knocked Down parts) but it counted.

From the 1980s onwards, such import duties were technically not allowed, so the Government re-worded them as a registration tax. Originally, that tax was levied against engine sizes — hence why so many Irish market cars were running small, 1.4-litre engines at a time when 1.6-litre and larger was the European norm — but since 2008, VRT has been calculated based on a car’s CO2 emissions. In that sense, the tax has found a new use, not just as a revenue generator for Government, but as a way of encouraging people to buy the lowest-emitting vehicle they can.

The current rates of VRT are:

Band 1: 0 - 50g/km - 7 per cent of OMSP

Band 2: 51 - 80g/km - 9 per cent of OMSP

Band 3: 81 - 85g/km - 9.75 per cent of OMSP

Band 4: 86 - 90g/km - 10.5 per cent of OMSP

Band 5: 91 - 95g/km - 11.25 per cent of OMSP

Band 6: 96 - 100g/km - 12 per cent of OMSP

Band 7: 101 - 105g/km - 12.75 per cent of OMSP

Band 8: 106 - 110g/km - 13.5 per cent of OMSP

Band 9: 111 - 115g/km - 15.25 per cent of OMSP

Band 10: 116 - 120g/km - 16 per cent of OMSP

Band 11: 121 - 125g/km - 16.75 per cent of OMSP

Band 12: 126 - 130g/km - 17.5 per cent of OMSP

Band 13: 131 - 135g/km - 19.25 per cent of OMSP

Band 14: 136 - 140g/km - 20 per cent of OMSP

Band 15: 141 - 145g/km - 21.5 per cent of OMSP

Band 16: 146 - 150g/km - 25 per cent of OMSP

Band 17: 151 - 155g/km - 27.5 per cent of OMSP

Band 18: 156 - 170g/km - 30 per cent of OMSP

Band 19: 171 - 190g/km - 35 per cent of OMSP

Band 20: greater than 191g/km - 41 per cent of OMSP

The OMSP is the Open Market Selling Price. For new cars, that’s basically the wholesale price as set by the manufacturer, but for those of us personally importing a car from abroad, it’s the price that The Revenue Commissioners calculate you would have paid for the car, had you bought it in Ireland. For commercial vehicles, VRT is calculated at 13.3 per cent of the OMSP, while for agricultural vehicles, larger commercials and HGVs, it's a flat €200 rate. For motorcycles there’s a charge of €2 per 1cc of engine capacity.

Once you’ve got your car on the road, you’ll need to pay motor tax, and here’s where it gets properly complex, because the tax you’ll pay will depend on the age of the car you’re driving.

Motor tax rates are now based on your CO2 emissions

For new car buyers, the current motor tax rates in Ireland are based on your CO2 emissions, and apply to cars registered from the 1st of January 2021. They are as follows:

0g/km: €120 per annum (this basically means fully-electric cars)

1 - 50g/km: €140 per annum

51 - 80g/km: €150 per annum

81 - 90g/km: €160 per annum

91 - 100g/km: €170 per annum

101 - 110g/km: €180 per annum

111 - 120g/km: €190 per annum

121 - 130g/km: €200 per annum

131 - 140g/km: €210 per annum

141 - 150g/km: €270 per annum

151 - 160g/km: €280 per annum

161 - 170g/km: €420 per annum

171 - 190g/km: €600 per annum

191 - 200g/km: €790 per annum

201 - 225g/km: €1,250 per annum

greater than 225g/km: €2,400 per annum.

If your car was registered between the 1st of January 2008 and the 31st of December 2020, you pay a slightly different tax rate:

Band A0: 0g/km. €120

Band A1: 1-80g/km. €170

Band A2: 81-100g/km. €180

Band A3: 101 to 110g/km: €190

Band A4: 111 to 120g/km: €200

Band B1: 121 to 130g/km: €270

Band B2: 131 to 140g/km: €280

Band C: 141 to 155g/km: €400

Band D: 156 to 170g/km: €600

Band E: 171 to 190g/km: €790

Band F: 191 to 225g/km: €1,250

Band G: 226g/km and up: €2,400

If you’re driving a car that was first registered before 2008 (unlikely, but you might be) then you’re on the truly ancient by-engine-capacity tax system, which goes like this…

1,000cc or less: €199

1,001cc to 1,100cc: €299

1,101cc to 1,200cc: €330

1,201cc to 1,300cc: €358

1,301cc to 1,400cc: €385

1,401cc to 1,500cc: €413

1,501cc to 1,600cc: €514

1,601cc to 1,700cc: €544

1,710cc to 1,800cc: €636

1,801cc to 1,900cc: €673

1,901cc to 2,000cc: €710

2,001cc to 2,100cc: €906

2,101cc to 2,200cc: €951

2,201cc to 2,300cc: €994

2,301cc to 2,400cc: €1,034

2,401cc to 2,500cc: €1,080

2,501cc to 2,600cc: €1,294

2,601cc to 2,700cc: €1,345

2,701cc to 2,800cc: €1,391

2,810cc to 2,900cc: €1,443

2,901cc to 3,000cc: €1,494

3,001cc or more: €1,809

Further complexity

Want more confusion? OK, let’s say that you have a van or a 4x4 pickup which technically qualifies as a commercial vehicle, but you want to use it for social, domestic, and pleasure use — dropping the kids to school, heading out for lunch at the weekend etc. You can do that — a simple phone call to your local tax office will do the job — but you are then shifted away from the flat-rate €333 per year commercial vehicle motor tax rate and onto the private car tax rate. But not the current CO2-based system. Oh no, you’ll have to tax your pickup or van according to the old engine-capacity system. Bizarre, but that’s how it works.

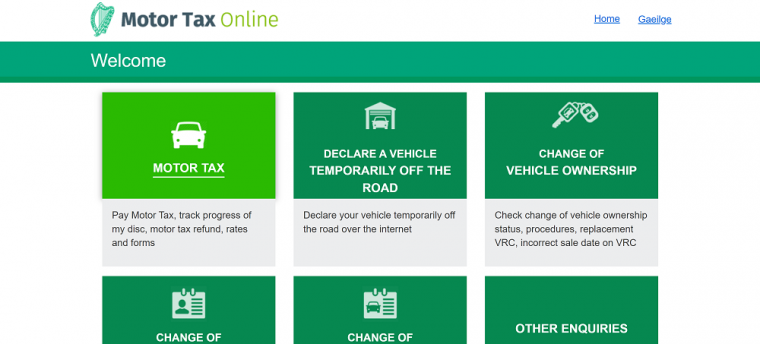

Please note that all of these costs and bands were correct at the time of writing, March 2022, and are subject to change, especially around Budget time in October. You can check with your local motor tax office for the specific rate for your own vehicle.