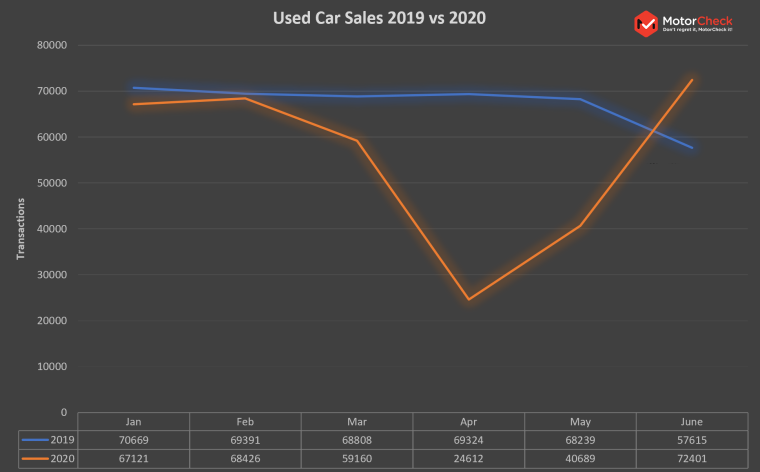

Sales of Used Cars in June 2020 have increased by more than 25% compared to June 2019

(figures to June

30th 2020)

The latest Used Car Sales stats compiled by MotorCheck today, show that the Used Car market in Ireland has bounced back strongly from the slump caused by the COVID-19 lockdown measures. Here are the highlights:

Used Car Transactions:

| _ | Jan | _ | Feb | _ | Mar | _ | Apr | _ | May | _ | Jun | _ | Total | |

| 2019 | 70,669 | 69,391 | 68,808 | 69,324 | 68,239 | 57,615 | 404,046 | |||||||

| 2020 | 67,121 | 68,426 | 59,160 | 24,612 | 40,689 | 72,401 | 332,409 | |||||||

| Change | -5% | -1.4% | -14% | -64.5% | -40.4% | 25.7% | -17.7% |

There were 72,401 Used Car transactions in June 2020 compared to 57,615 in June 2019, an increase of 25.66%. This increase comes on the back of 3 devastating months due to lockdown, where used car transactions decreased by 14% in March, 65% in April and 42% in May.

The increase in used car transactions during the month of June is largely attributable to pent-up demand from March, April and May. There was a shortfall of approximately 82,000 used car transactions during this period, so it is likely that we will see and increased level of activity in the used car market in the coming months. We are also hearing anecdotal evidence from dealers that many customers are new entrants to the market, preferring to opt for a small used car rather than returning to public transport.

The stats show that 60% of the used car transactions are private sellers, 20% are from dealers whilst the remaining 20% are a made up of trade transactions (16% trade-ins to dealers and 4% inter-trade transactions).

The news is not all positive however as the increased demand combined with difficulties in accessing used stock from the UK is bound to lead to price increases in the Used Car Market along with a shortage of good quality used stock.

Used Cars imported from the UK were already trending downwards year-on-year before lockdown, however imports in April and May were down 97% and 91% respectively, whilst imports in June are down 47.5%.

Used Car Imports:

| _ | Jan | _ | Feb | _ | Mar | _ | Apr | _ | May | _ | Jun | _ | Total | |

| 2019 | 9,114 | 8,916 | 9,063 | 9,028 | 9,556 | 8,168 | 53,845 | |||||||

| 2020 | 6,769 | 6,337 | 4,739 | 199 | 859 | 4,285 | 23,188 | |||||||

| Change | -25.7% | -28.9% | -47.7% | -97.8% | -91% | -47.5% | -56.9% |

We are already seeing a hardening of Used Car Prices across both the UK and Irish market with 2-to-5 year old cars coming onto the market at higher prices than they would have achieved before the lockdown. This is bound to continue as Dealers in Ireland burn through current stocks, and with the flow of imports from the UK not as accessible as it was previously there may be a shortage of used stock in future months which could exacerbate the situation.

Despite the downward trend in UK imports the Used Car Market is faring significantly better than the New Car Market at present. Overall the Used Car Market is down 17.73% year on year with Used Car Imports down 56.94%. By way of comparison the New Car Market is down 32.6% year on Year.

New Car Sales:

| _ | Jan | _ | Feb | _ | Mar | _ | Apr | _ | May | _ | Jun | _ | Total | |

| 2019 | 32,487 | 15,148 | 16,745 | 8,917 | 6,328 | 1,426 | 81,051 | |||||||

| 2020 | 31,380 | 13,925 | 6,180 | 334 | 1,753 | 1,017 | 54,589 | |||||||

| Change | -3.4% | -8.1% | -63.1% | -96.3% | -72.3% | -28.7% | -32.6% |