Used cars imported from the UK continue to decline for the second month in a row as exchange rates remain unattractive

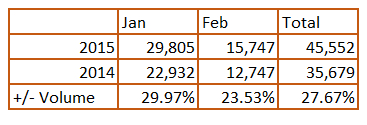

Figures released by Car Data experts Motorcheck.ie today show the boom in new car sales boom continued in February with a 24% increase for the month against 2014 figures. Combined with the increase in January this is a 28% increase year-to-date against 2014. That’s approximately 10,000 additional new cars registered in the first two months of the year versus 2014.

The new car market continues to perform as expected this year with growing consumer confidence and readily available finance resulting in steady increases in sales.

The used car market has also increased significantly year on year, however, the choice and availability of good used car stock remains tight due to previous lean years in new car sales combined with current sterling exchange rate making it less attractive to import from the UK.

We have now seen the second straight month where the number of used cars imported from the UK and Northern Ireland has decreased. This is unheard of in recent years. Demand in the used sector remain high so the knock-on effect for used car buyers is that used prices are remaining steady and choice is at a premium. In times such as this consumers need to keep their wits about them as heightened demand can pressurise buyers into making hasty decisions. We would urge car buyers to always keep a level head and the golden rule is that if deal looks too good to be true then it probably is.

New Car Stats Highlights (to end of February 2015)

• All the top ten makes and top ten models of 2015 have increased the number of registrations over the first two months in 2014

• The top four manufacturers maintain the top four spots in 2015 as in 2014, when compared to the prior year – VW, Toyota, Ford & Hyundai

• The top four models retain the top four spots in 2015 as in 2014, when compared to the prior year – VW Golf, Ford Focus, Toyota Corolla & Skoda Octavia

• The only decline in the main figures are used imports which are down 2.42% in 2015 ytd – 3.68% in January 2015 and 1.14% in February 2015 respectively

Total Registrations for January and February 2015

Top ten makes - Year to date (Feb 28th 2015)

Top ten models - Year to date (Feb 28th 2015)

Used Car Imports - Top ten models - Year to date (Feb 28th 2015)